Investing for your retirement isn't about getting rich quick. More often, it's about having a game plan that you can live with over a long time. You wouldn't expect to be able to play the piano without learning the basics and practicing. Investing for your retirement over the long term also takes a little knowledge and discipline. Though there can be no guarantee that any investment strategy will be successful and all investing involves risk, including the possible loss of principal, there are ways to help yourself build your retirement nest egg.

Compounding is your best friend

It's the "rolling snowball" effect. Put simply, compounding pays you earnings on your reinvested earnings. Here's how it works: Let's say you invest $100, and that money earns a 7% annual return. At the end of a year, the $7 you earned is added to your $100; that would give you $107 in your account. If you earn 7% again the next year, you're earning 7% of $107 rather than $100, as you did in the first year. That adds $7.49 to your account instead of $7. In the third year with a 7% return, you'd earn $8 and have a total of $122. Like a snowball rolling downhill, the value of compounding grows the longer you leave your money in the account. In effect, compounding can do some of the work of building a nest egg for you.

The longer you leave your money at work for you, the more exciting the numbers get. For example, imagine an investment of $10,000 at an annual rate of return of 8%. In 20 years, assuming no withdrawals, your $10,000 investment would grow to $46,610. In 25 years, it would grow to $68,485, a 47% gain over the 20-year figure. After 30 years, your account would total $100,627. (Of course, these are hypothetical examples that do not reflect the performance of any specific investment and assume that no taxes are paid or withdrawals are made during that time.)

If your workplace savings plan contributions are made pretax, as most people's are, compounding really becomes a powerful force. Not having to pay taxes from year to year on either your contributions or the compounded earnings helps your savings grow even faster (though you'll owe taxes on that money when you start withdrawing from your account). The value of compounded tax-deferred dollars is the main reason you may want to fully fund all tax-advantaged retirement accounts and plans available to you, and start as early as you can. Investing money over time can help compounding produce potentially significant returns. With time on your side, you don't necessarily have to aim for investment "home runs" in order to be successful.

Diversify your investments

Asset allocation is the process of deciding how to spread your dollars over several categories of investments, usually referred to as asset classes. A basic asset allocation would likely include at least stocks, bonds, and cash or cash alternatives such as a money market fund. The term "asset classes" also may refer to subcategories, such as particular types of stocks or bonds.

Asset allocation is important for two reasons. First, the mix of asset classes you own is a large factor — some say the biggest factor by far — in determining your overall investment portfolio performance. How you divide your money between stocks, bonds, and cash can be more important than your choice of specific investments. Second, by dividing your portfolio among asset classes that don't respond to market forces in the same way at the same time, you can help minimize the effects of market volatility while maximizing your chances of long-term return. Ideally, if your investments in one class are performing poorly, assets in another class may be doing better and may help stabilize your portfolio.

Remember that during any given period of market or economic turmoil, some asset categories and some individual investments historically have been less volatile than others. You can manage your risk to some extent by diversifying your holdings among various classes of assets, as well as different types of assets within each class. Taking steps that can help manage the amount of volatility you experience can help you stay with your game plan over the long term.

Take advantage of dollar-cost averaging

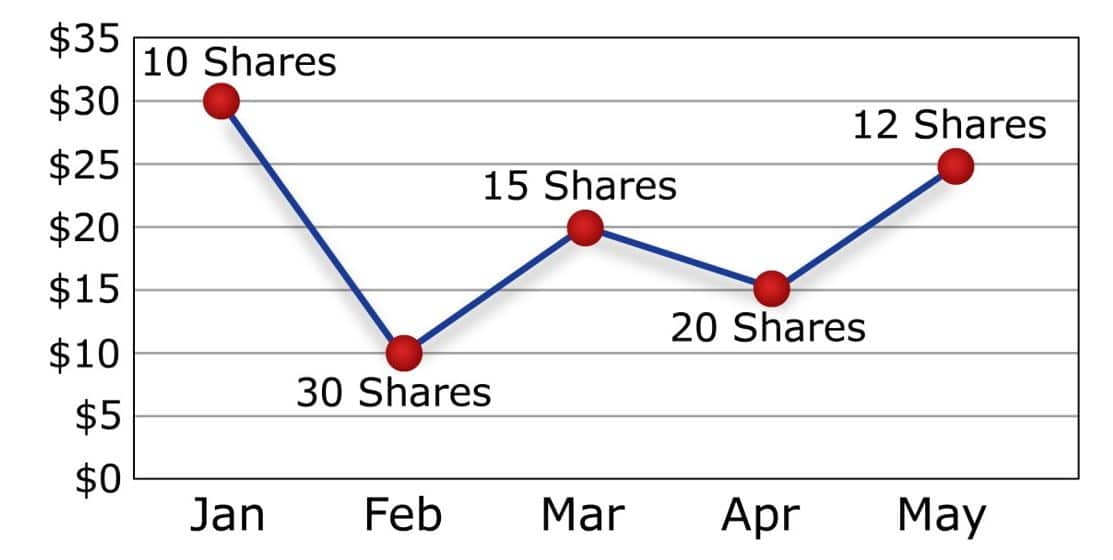

One of the benefits of participating in your workplace savings plan is that you're automatically using an investment strategy called dollar-cost averaging. With dollar-cost averaging, you acquire shares of an investment by investing a fixed dollar amount at regularly scheduled intervals over time. When the price is high, your investment buys less; when prices are low, the same dollar investment will buy more shares. A regular, fixed-dollar investment should result in a lower average price per share than you would get buying a fixed number of shares at each investment interval.

The accompanying graph illustrates how share price fluctuations can yield a lower average cost per share through dollar-cost averaging. In this hypothetical example, ABC Company's stock price is $30 a share in January, $10 a share in February, $20 a share in March, $15 a share in April, and $25 a share in May. If you invest $300 a month for 5 months, the number of shares you would buy each month would range from 10 shares when the price is at $30, to 30 shares when the price is $10. The average market price is $20 a share ($30+$10+$20+$15+$25 = $100 divided by 5 = $20). However, because your $300 bought more shares at the lower prices, the average purchase price is $17.24 ($300 x 5 months = $1,500 invested divided by 87 shares purchased = $17.24).

In addition to potentially lowering the average cost per share, investing the same amount regularly automates your decision making, and can help take emotion out of investment decisions.

Stick to your strategy

Try to resist the impulse to change your investment strategy with every news headline or investing tip from a relative or coworker. Timing the market correctly is very difficult; even professionals find it a challenge. Most people fare better by having an investment game plan that can weather good times and bad and then sticking to it.

That doesn't mean you should simply forget about your investments altogether. At least once a year, you should review your portfolio to see if your choices are still appropriate. Even if your circumstances haven't changed, market movements can affect how your money is divided among various types of investments. For example, if one type of asset has been very successful, it may now represent too large a share of your holdings. To rebalance your portfolio, you could sell some of an asset that's now larger than you intended and buy more of a type that is lower than desired. Or you could keep your existing allocation but shift future investments into an asset class you want to increase. But if you don't review your holdings periodically, you won't know whether a change is needed.

Ready to start investing today?

Important Disclosures:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The information provided is not intended to be a substitute for specific individualized tax planning or legal advice. We suggest that you consult with a qualified tax or legal professional.

LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial.

This article was prepared by Broadridge.

LPL Tracking #1-918759